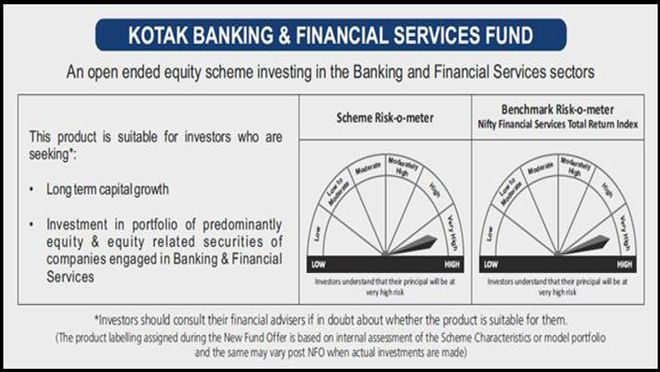

Kotak Mutual Fund is launching new fund offer (NFO) under its “sectoral category”, named as Kotak Banking & Financial Services Fund. The open-ended fund will invest in the equity and equity-related securities of companies engaged in banking and financial services sector.

Investment Strategy: The scheme aims to generate wealth over long-term by investing predominantly in equity and equity related securities across banking and financial services sector.

Asset allocation: The Scheme shall invest predominantly in equity and equity related securities of companies engaged in banking and financial services sectors. The classification of Financial Services Companies would be guided by the AMFI Sector classification or other financial services to be identified by the fund manager.

Who should invest?

Investors with high-risk appetite should invest in the scheme for the long-term of at least 5 years. Those who want to create wealth over long-term by investing in banking and financial sector.

Risk associated: Very high level of risk.

Benchmark: Nifty Financial Services Total Return Index

Fund Managers: Ms. Shibani Sircar Kurian, Mr. Abhishek Bisen, Mr. Arjun Khanna.

The NFO is available for subscription from February 06-20 and re-open for continuous sale and repurchase from March 06. The schemes will reopen for continuous sale and repurchase within five Business Days from the date of allotment. The fund offers systematic investment solutions like SIP and SWP to create a flexible investment plan. The minimum subscription amount is Rs 5,000/- and in multiples of any amount thereafter.

It offers Regular Plan and Direct Plan. Each plan offers Growth and Income options. Click here to invest in Kotak Banking & Financial Services Fund.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Securities Support WhatsApp Number

IIFL Securities Support WhatsApp Number

+91 9892691696

www.indiainfoline.com is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others.

Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.