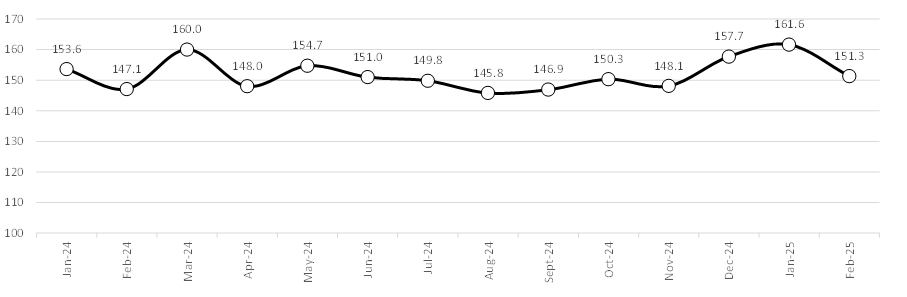

The IIP decelerated sharply in February 2025. Its YoY growth came in at 2.9% year on year, lower than the corresponding 4% market consensus and the slowest pace of expansion in six months. This marks a significant slowdown from the 5.2% annualized growth rate revised in January, and records widespread weakness across major industrial sectors.

.*IIP data is reported with a lag of 42 days and undergoes changes. The recent months are still estimates and will be revised over the next two months.

Figure: IIP Trend

Source: MOSPI

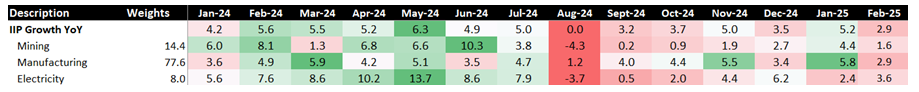

Manufacturing records the slowest growth since August of last year

In the industrial sector, there was a divergence across main segments. Manufacturing, the largest component of the IIP, decelerated sharply after showing impressive recovery in the past three months. Its growth slowed to 2.9%. This is the weakest since August of last year and the second weakest since January of last year.

On the other hand, Electricity consumption witnessed an acceleration. This is likely due to higher temperatures in 2025. The average temperatures during Jan to March were much higher than last year and even long-term averages.

Figure: Analysis of IIP Growth YoY – Sectoral Classification

Source: MOSPI

Tech Booms, Petrochem Slows, Metals Hold Firm: Shifting Sands in Manufacturing

As per sector-wise analysis of manufacturing, in February 2025, 40% of sub-sectors witnessed contraction. Apparel, a robust growing sector, witnessed its first decline since February 2024. Food products saw their 2nd biggest decline in a year. Beverages witnessed their worst performance in a year. Among large contributors, refined petroleum products witnessed significant deceleration after two months of strong growth. Also, chemicals declined and registered their worst performance in a year. Overall, a significant slowdown across some of the major contributors.

The bright spot remained metals and mineral products. Both of them continued to witness robust growth. While the growth decelerated moderately, they still witnessed amongst the highest growth rates in a year. Similarly, many technology and capital goods sectors showed robust expansion. Computer, electronic and optical products increased by 10.6% YoY while electrical equipment and machinery & equipment were up 9% and 3%, respectively. This indicates better momentum in tech-driven industries and capital goods.

Figure: Trends in Manufacturing – IIP

Source: MOSPI

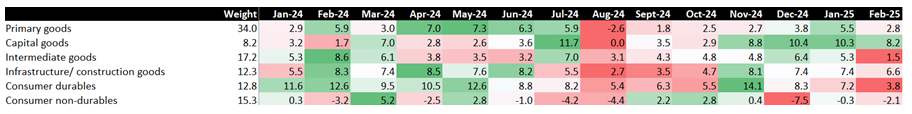

Analysis of Use Based Classification:

Momentum decelerated across every segment in February 2025. The deceleration was sharp in Primary Goods, Intermediate Goods and Consumer Durables. The deceleration in Intermediate Goods suggests weakness in demand from downstream industries. Consumer Durables, too, after witnessing robust growth might be feeling the pinch of higher inflation and base effects.

Figure: Analysis of IIP Growth YoY – Usage Based Classification

Source: MOSPI

Is the slowdown worse than anticipated?

The IIP in February 2025 came in below expectations. The slowdown in manufacturing and mining highlights the increasing caution in both consumers as well as businesses. Even the pickup in Electricity does not increase optimism as it is likely related to higher temperatures sweeping India.

Capital goods have been one of the brighter spots, with the sector continuing to post strong numbers, hinting at greater capital expenditure by businesses. Also, a 6.6% YoY growth in the infrastructure and construction goods sector as well indicates ongoing public and private sector outlays toward infrastructure projects, which has positively impacted industrial activity.

On the other hand, consumer non-durables continued to weigh on the index, decreasing for the third month in a row. Such continued weakness mirrors muted rural demand and likely price pressures on necessities. Consumer durables growth also dipped significantly. These highlight the growing weakness in consumption, likely driven by higher prices.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248

ARN NO : 47791 (AMFI Registered Mutual Fund Distributor)

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.