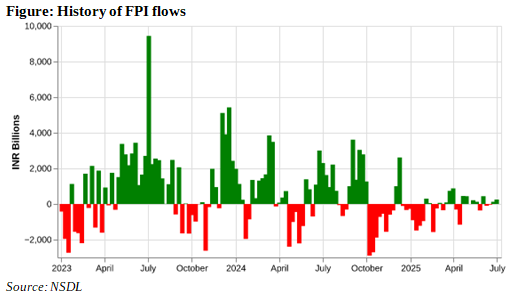

In a week that saw a moderation in geopolitcal sentiment, risk-on trades were back. Tech heavy indices global indices rallied, Emerging Markets followed suit and Oil prices plunged. In Indian markets, FII inflows increased materially. While still below the long term average, the recent inflows continue to reverse the damage caused in the early part of the year due to significant outflows. Notably, inflows were positive in both the equity and debt segments.

FPI flows for the week

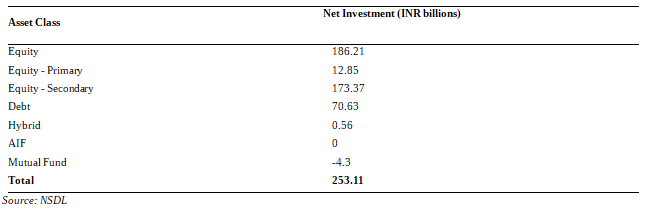

FII flows for the week were strong at INR 253.11 billion. Most of the inflows have been in secondary equity market, to the tune of INR 173.37 billion. Also a substantial INR 12.85 billion of primary equity flowed in, indicating favorable mood for the new issuances. The hybrid category has seen a net inflow of INR 0.56 billion and the mutual funds segment has witnessed a net outflow of INR -4.3 billion. The debt space has seen heavy flows of INR 70.63 billion, highlighting the demand for fixed income instruments too.

Figure: YTD FPI/FII flows for the week ending 2025-06-27

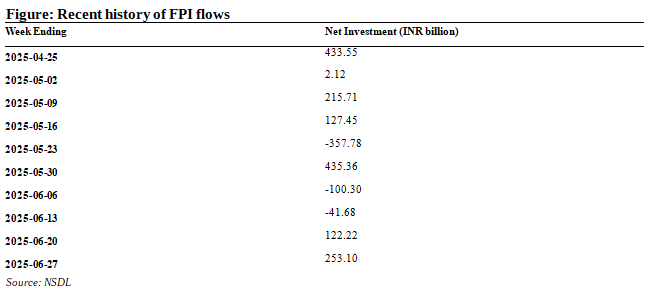

A weekly history of FPI flows:

The last week’s FII/FPI net investment of INR 253 billion, while below the long term average of INR 551 billion is above the year-to-date average of INR -177 billion. After witnessing outflows in early part of June, FII inflows improved considerably in the later half. This was the 2nd consecutive week of positive FII flows into Indian markets. The investment in the latest week was more than double the investment of INR 122 billion for the previous week, and a sharp recovery from the outflows of INR -100 billion and INR -41 billion in the prior weeks.

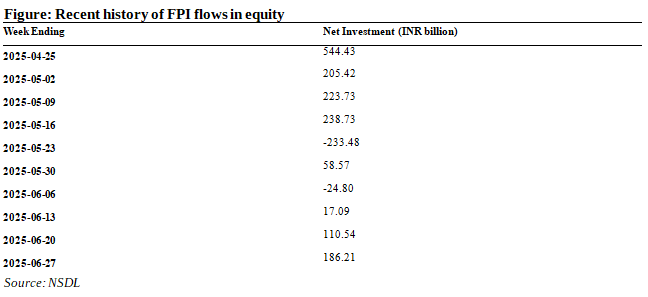

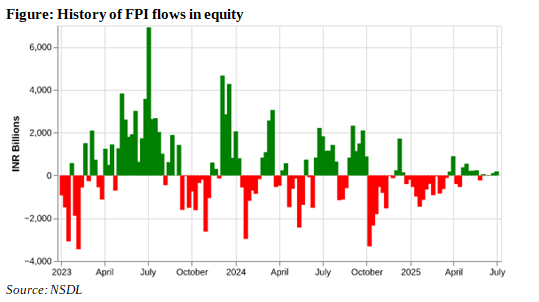

A weekly history of FPI flows in Equity:

Indian equities continue to see a reversal of fortunes, with respect to FII flows. After witnessing significant outflows in the early part of 2025, they have improved in the recent weeks. The latest week’s FII/FPI net investment of INR 186 billion is noticeably below the long-term average of INR 258 billion, but much higher than the YTD average of INR -227 billion. A comparison of recent weeks also shows that FPI inflows have continuously increased every week for the past 3 weeks.

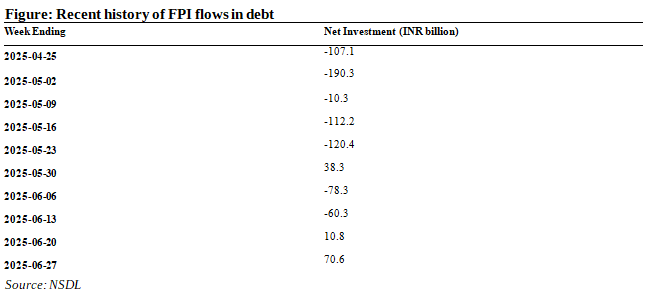

A weekly history of FPI flows in Debt:

The FPI flows into debt for the week was at INR 70.6 billion, below the long-term weekly average FII/FPI net investment of INR 271.3 billion but above the year-to-date weekly average of INR 52.3 billion. During the last 10 weeks, it has to be noted that FPI flows were negative in severn of them; and last week’s inflow was the largest inflow in the past 10 weeks.

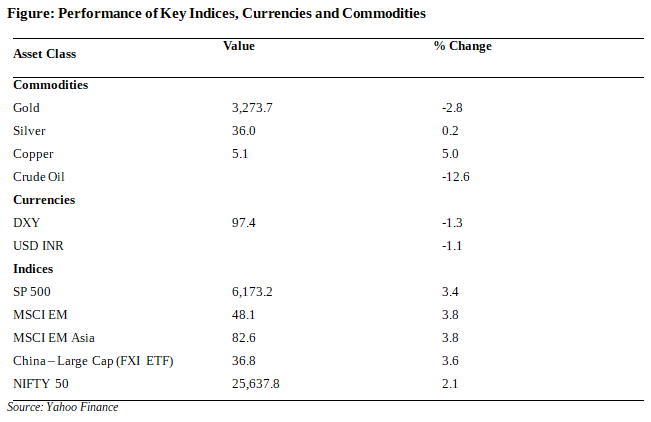

How have the major indices, currencies and commodities performed?

Last week saw a broad-based rally across global equity indices, led by tech-heavy benchmarks and emerging markets. The Nasdaq (+4.25%), S&P 500 (+3.44%), and Dow Jones (+3.82%) posted strong gains, reflecting investor optimism around economic resilience. Emerging markets followed suit, with MSCI EM Asia (+3.83%) and China’s FXI ETF (+3.63%) also rising, aided by softer dollar trends (DXY -1.33%, USD/INR -1.06%) and risk-on sentiment. India’s Nifty 50 climbed +2.09%, in line with broader EM strength.

On the commodity front, Copper surged (+5.02%) on renewed industrial demand hopes, while Crude Oil plunged (-12.56%) amid oversupply concerns and weak demand signals. Gold (-2.80%) and Silver (+0.17%) was mixed as real yields edged higher.

Overall, the week reflected a shift toward growth and risk assets, supported by dovish macro signals and improving EM sentiment.

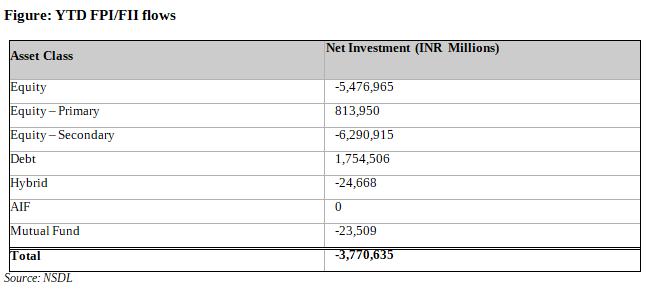

YTD FPI flows

The year-to-date (YTD) FII inflows chart suggests a mixed picture across asset classes. Primary Equity received strong inflows of INR 813.95 billion and Secondary Equity saw large outflow of INR 6290.92 billion, which resulted in a net outflow of INR 5476.96 billion in the segment. This indicates that FIIs have preferred primary market over secondary market investments. Debt has witnessed a robust inflow at INR 1754.51 billion showing a bias towards fixed income. In totality, the figures point to a cautious approach by the FIIs that have sold INR 3770.64 billion YTD.

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016

ARN NO : 47791 (AMFI Registered Mutual Fund Distributor)

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.