What Is Sub-broker And Benefits Of Being A Sub-broker?

The emergence and rapid development of the stock market have created numerous opportunities in the industry for investors to make money. Owing to these numerous profit-making opportunities, the Indian stock market is witnessing unprecedented demand from the opening of record-breaking Demat accounts.

Technological advancements from Stock exchanges to brokers have enabled certain processes to be completely digitised. The most innovative process is digitising the trading platforms and the included system. For example, a plethora of online discount brokers are essentially apps that enable you to trade in the stock market through them, with little to no human intervention.

However, physical assistance is still required for investors who prefer having an expert to assist them in transactions and for online brokers to find new customers. The role known as authorised partner (previously known as sub-broker) has become pivotal in the spectrum of trading today.

This article will break down the concept of sub-brokers (now known as authorised partners) alongside an in-depth explanation of what they are, how one can become an authorised partner and its various benefits.

What Is a Sub Broker?

You have probably heard of a broker but are unaware of what an authorised partner is in the share market. If you are, here is the answer to what is a sub-broker (Also known as an Authorised Partner).

A sub-broker (Authorised Partner) is a person who functions similarly to a broker but works as the middleman between two parties: the customer and the main broker. While a stock broker is the middleman between an investor and the stock exchange, a sub-broker is the middleman between the stockbroker and the investor.

The job of an authorised partner is to mediate between the broker and client and assist the client in various activities such as financial transactions and paperwork. Since the authorised partner works for a stock broker, in most cases, their job includes bringing clients to the brokerage firm. Additionally, the authorised partner assists clients with investing and dealing with securities. In return for the services rendered by the authorised partners to the brokers, they receive a certain commission from the transaction done by the clients.

Now that you have understood what an authorised partner is, you can move on to understanding the concept in detail.

Roles and Responsibilities of Authorised Partners

Sub-brokers (now known as authorised partners) play a pivotal part in equities markets, acting as delegated representatives approved by lead brokers to facilitate trades on their behalf. Here is a breakdown of their principal obligations and roles:

- The primary broker sanctions authorised partners to function on their behalf. They must abide by the regulations and rules established by the lead broker and regulatory bodies.

- With appropriate registration from SEBI, they can offer various customer services, including investment recommendations, portfolio management, and research reports. They also assist clients with adhering to compliance requirements and documentation.

- They earn payment from transactions completed by customers in return for the functions they carry out for brokers. The commission received varies depending on trade size and complexity.

- They must conform to the standards established by regulatory authorities. They ensure clients comprehend the risks involved in securities investing. Compliance is essential to maintain licences.

- They help expand the reach of lead brokers by attracting new clients and retaining present ones through high-quality service. Their relationships and local knowledge play a key role in business development.

Difference Between Sub Broker and Stock Broker

Criteria | Stock Broker | Sub Broker (authorised partner) |

Definition | Authorised individual in a stock exchange | Appointed by a broker |

Responsibility | Performs trades for clients | Intermediary between brokers and clients |

Registration | Registered with SEBI and different stock exchanges | Registered by an exchange member |

Services offered | Buying and selling of stocks | Assists with order execution and client acquisition |

Fees | Brokerage fees are charged according to a flat rate or different trades | Commissions earned through client transactions |

Compliance | Authorised for transactions in asset markets | Compliance with SEBI regulations is compulsory |

Supervision | Independent and not under the supervision of others | Supervised by the main broker |

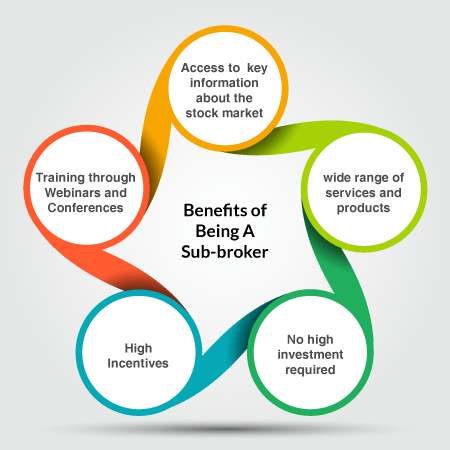

Benefits of Being a Sub Broker

Financial Knowledge:

One of the biggest benefits of being an authorised partner or part of an authorised partner franchise is the financial knowledge you gain. Working under a broker provides authorised partners with key information about the stock market that they can use to further their market knowledge and personal trades. While they cannot function as brokers, they can still trade personally with any broker with their funds. This self-sufficient cycle not only enables authorised partners to cater to their clients better but also lets them fuel their investments as well.Added Services

Another benefit of being an authorised partner is that the brokerage firm you work with might enable you to provide customers with services beyond investment tips and strategy. For example, some brokers allow their authorised partner franchisees to offer clients mutual fund distribution and loan options. Because of these added services, the authorised partner gets opportunities to earn a commission and grow the authorised partner franchise.Low Investment Amount:

Once you know what an authorised partner is, you understand you do not need a high capital amount to start. One of the major benefits of being an authorised partner is that you do not require a high investment amount, as your franchiser takes care of most of the expenses. Authorised partners only require a small investment amount, say 10,000 rupees or above, to begin their quest as an authorised partner. Irrespective of the initial investment amount, there is no limitation on the commission an authorised partner can earn based on the client’s transactions.

What Do You Need To Become An Authorised Partner?

To become an authorised partner, several requirements and steps must be followed. Here’s a concise list of what you need:

- Educational Qualifications: A minimum 10+2 degree is compulsory to become an authorised partner. A bachelor’s degree in finance, commerce, or a related field is often preferred. Understanding market dynamics, financial instruments, and trading strategies is also crucial.

- Registration with SEBI: Register as an authorised partner with the Securities and Exchange Board of India (SEBI). Adhere to all SEBI regulations and guidelines for authorised partners.

- Partnership with a Stock Broker: Collaborate with a licensed stock broker to operate under their umbrella. Sign a partnership agreement detailing the terms of your relationship and commission structure.

- Financial Requirements: Maintain a minimum net worth specified by SEBI or the partnering stock broker. Prepare for initial investments in infrastructure and marketing to attract clients.

- Infrastructure Setup: Establish a physical office or a digital presence to operate and serve clients. Gain access to the trading platform the stock broker provides for executing trades.

- Licensing and Certifications: Obtain the National Institute of Securities Markets (NISM) certification, such as the NISM-Series-X-A: Investment Advisor Certification Examination.

- Compliance and Reporting: Regularly follow compliance requirements set by SEBI and the stockbroker. Maintain proper records and report transactions as required.

- Client Acquisition Strategy: Develop strategies to attract and retain clients, such as networking, online marketing, and educational seminars.

Conclusion

The role of a sub broker is the result of an increase in demand for brokers as people generate excess amounts of funds and income that they wish to invest. While being a broker requires extensive permissions and certifications, being a sub broker allows you to carry out similar functions, short of being listed as a trading member of the stock market. You can consider partnering with reputed organizations like IIFL securities to smooth your process for the same and make use of their existing expertise.

FAQs On What Is Authorised Partner

Ans: An authorised partner is a representative of a broker. A broker is a member of the stock exchange. An authorised partner can interact with customers as an authorised representative of the broker. There are many benefits of being an authorised partner. An authorised partner recruits new customers on behalf of the broker. They earn a commission from the broker for the new customers that it gets for the broker. The authorised partner also earns a commission from the broker on trades done by customers they have recruited. The authorised partner also gets the research & advisory support of the broker. The authorised partner can enjoy the brand name of a top broker such as IIFL Securities.

Ans: An authorised partner needs to be registered with SEBI, as per the requirement of Section 12 (1) of the SEBI Act, 1992. An authorised partner can take the franchise of a broker. A franchisee may not necessarily be an authorised partner. A franchisee may have the franchise only for selling other financial products such as mutual funds, insurance products, etc. So, a franchisee doesn’t need to be registered with SEBI. But if an authorised partner who deals in securities takes a broker’s franchise, then the partner should be registered with SEBI.

Ans: As per current SEBI regulations, there is no difference in the role of sub-brokers and Authorised Persons. In fact, sub-brokers are now called authorised partners. APs do not have to be registered with SEBI. The broker or authorised partner appointing an AP should only get the AP registered with relevant stock exchanges.

Authorised partners are allowed to trade in the cash market segment only on behalf of the clients. An AP can trade in cash, derivatives, and currency derivatives segments on behalf of the clients. However, APs cannot handle the money of the clients directly.

Ans: Completing 10+2 education is compulsory to become an authorised partner. Knowledge about financial markets is necessary. A bachelor’s degree in a finance-related field can be advantageous.

Ans: Authorised partners are appointed by main brokers to help clients on their behalf. Authorised partners must follow the regulations fixed by the main broker and the exchange authorities.