India’s Goods and Services Tax (GST) has been a prominent focus of economic discussions, and finance minister Nirmala Sitharaman is anticipated to consider GST numbers when presenting her next Budget in July.

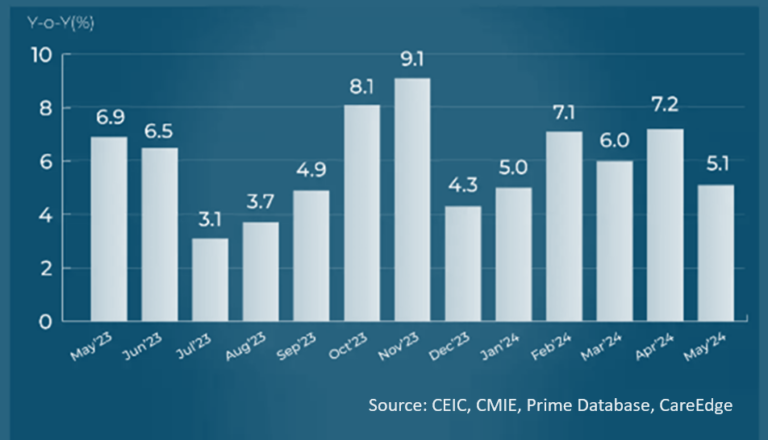

GST collection reached a new high of ₹2.1 lakh Crore in April 2024, indicating the resilience of the economy. Robust GST receipts have reduced the load on government budgets. Strong tax collection, both direct and indirect, has been a fundamental reason why the Modi government has stuck to its budgetary glide path.

GST collections in May totalled ₹1.73 lakh Crore, indicating that the system is maturing as compliance grows. It offers a framework for further streamlining tax slabs.

Strong economic momentum will guarantee that GST collections continue to set new highs in the coming months, allowing the government to focus more on its capex plan. With the sale of public assets and a record RBI dividend, the government can strike on both fronts: capex and welfare.

GST, which was implemented in 2017, is a significant indirect tax reform that has helped unify a variety of taxes. According to the most recent Budget documents, the GST accounts for 18 paise of every 1 rupee received by the government.

As the government prepares for Budget ’24, existing tax, investment, and welfare policies will be essential. The notion of continuity and strategic realignment is likely to influence budgetary decisions, ensuring a smooth transition while responding to changing economic demands.

With a coalition government in existence, the budget must strike a balance between growth targets and the priorities of coalition members in order to maintain economic stability and promote development.

It will also be the first complete budget under the newly constituted Modi 3.0 administration.

This budget is likely to be a watershed moment in India’s economic destiny, as the country navigates a volatile political landscape.

For feedback and suggestions, write to us at editorial@iifl.com

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Securities Support WhatsApp Number

IIFL Securities Support WhatsApp Number

+91 9892691696

www.indiainfoline.com is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others.

Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.