Forex reserves hold paramount importance to emerging economies. Historically, issues related to exchange rates and forex reserves had severely impacted many Asian economies. A case in point being the Asian Financial Crisis, where countries with insufficient forex reserves fared worse.

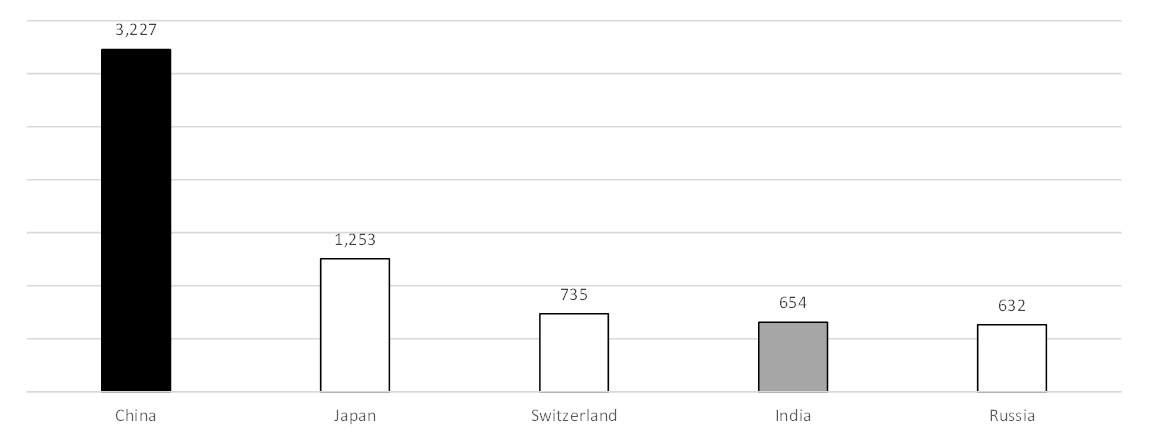

Due to such historical reasons and being amongst the most important players in global trade, both Indian and China maintain a significant amount of forex reserves. While China ranks #1 in its forex reserves, India Ranks #4.

Figure: Top 5 countries with highest forex reserves

Source: Central Banks of respective countries

Trends in Forex Reserves – India vs China

India

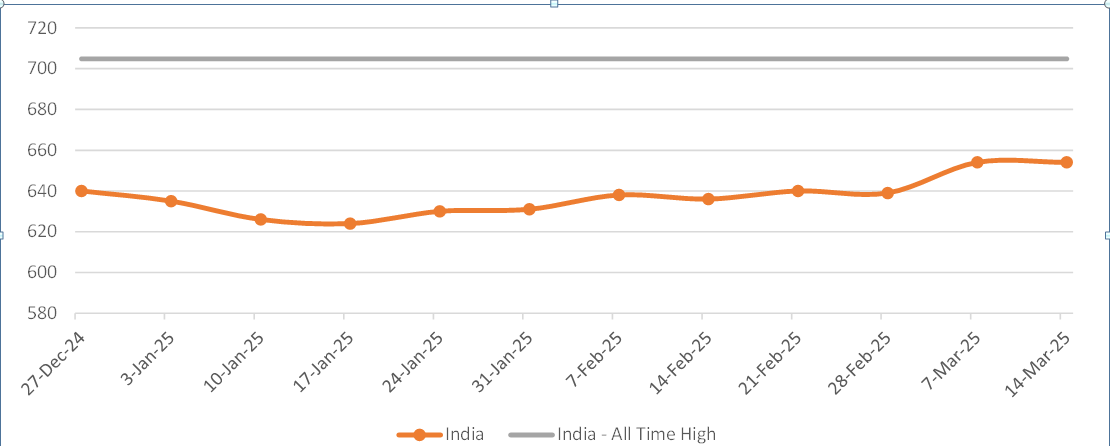

High forex reserves are also a key policy tool for the central banks. It gives them the ability to tightly regulate exchange rates. As such, during periods of RBI intervention to bolster the INR, India’s forex reserves have dipped.

In 2024, India’s has seen its highest every accumulation of forex reserves. They had reached a high of USD 705bn. One of the key reasons has been RBI’s lack of aggressive intervention to stem the slide of INR. However, lately, RBI has dipped into forex reserves to support the INR. While the INR has deprecated even after that, the slide would likely have been worse if the intervention didn’t happen.

In the week ended 14 March 2025, India’s forex reserves had increased by USD300m (week on week). While the current reserves are still USD50bn less than 2024’s peak, they have increased by USD30bn since January lows. In addition to the increase in foreign currency assets, increasing prices of gold have also likely been the reason for the increase.

Figure: India Forex Reserves witnessed a modest increase

Source: RBI

China

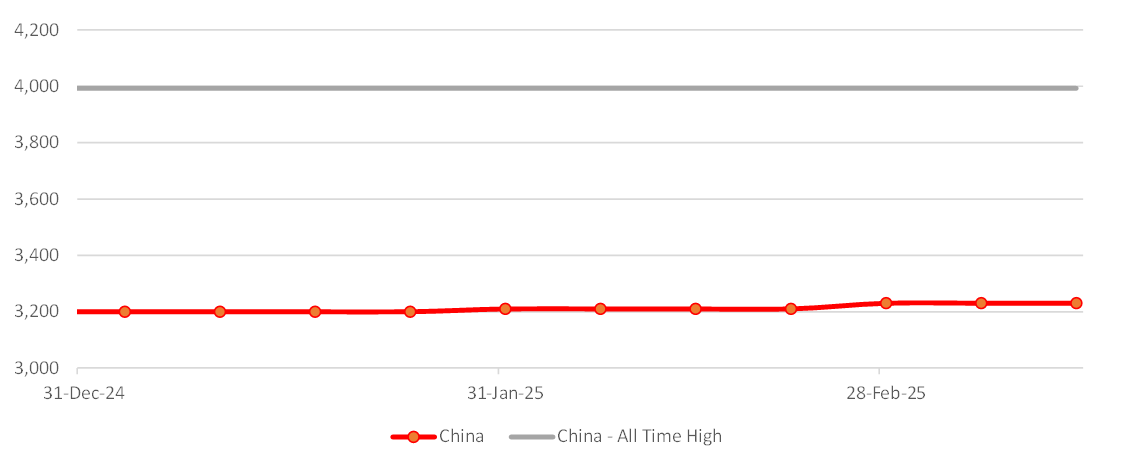

China is the world’s largest holder of forex reserves. That said, its reserves peaked more than 10 years ago at nearly USD4trn. Current reserves of USD3.23trn are nearly USD 750bn less than its peak reserves.

Part of the fall in reserves has been strategically orchestrated to reduce its concentration of US and USD based assets. For instance, China was the world’s largest holder of US treasuries. The lower share of USD assets and an appreciating USD index has also weighed on its overall forex reserves.

Unlike India where forex reserves are disclosed weekly, China discloses them only monthly. As per the latest available data, its forex reserves have witnessed a modest increase in 2025. They had increased by USD10bn in January and USD20bn in February

Figure: China Forex Reserves witnessed a modest increase

Source: PBOC

Related Tags

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.