Table of Content

A microfinance institution or micro-finance lender gives small, unsecured loans to people from poorer sections of the society. Usually, the maximum amount of loan that a micro-finance lender gives is Rs 1 lakh. These loans are usually given for meeting the daily needs of the borrower or the needs of the borrower to buy some income-generating asset.

Microfinance is a recent phenomenon. Noble laureate Mohammed Younus conceived the idea of micro finance with his Grameen Bank institution. Microfinance has proved to be effective in meeting the financing needs of some of the poorest people of the society. It has helped in improving their standard of living.

Microfinance loans are unsecured loans. There is no collateral or security given by the borrower unlike in the case of gold loan or business loan. Since it is an unsecured loan, the credit risk is higher. Credit risk is the risk that the borrower may default on payment of interest or principal when they become due. Credit risk of micro-finance lenders is also compounded by the fact that they lend to people coming from economically weaker sections of the society. To compensate for this higher credit risk, the interest rate charged on micro-finance loans is higher than the interest rate charged on gold loans or business loans or personal loans.

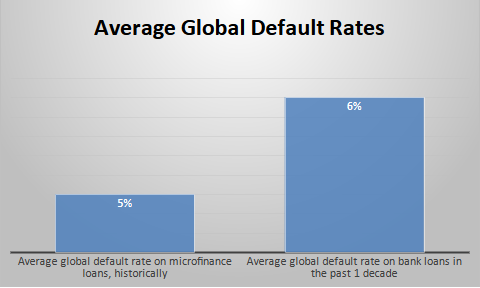

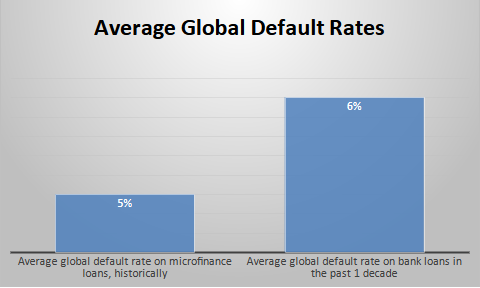

Data source, Average default rate on bank loans, E&Y

In spite of their higher credit risk, microfinance borrowers have proved to be quite reliable in paying back their loan obligations. Globally, the average default rate on micro-finance loans is just 5%. According to data from E&Y, average default rate on bank loans, globally, has been around 6% in the past 1 decade.

To lower their credit risk further, microfinance borrowers prefer to give loans to groups of borrowers such as a self-help group of women. All the members of the group are responsible for paying back the obligations on the loan.

IIFL Samasta is an example of microfinance institution.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.