There was a time when trading was considered an investment avenue available only to a select few. However, with the advent of online tools and platforms, trading has become an accessible option for almost everyone with exposure to the digital spectrum. If you have an internet connection, adequate capital and want to start investing in the stock market, you can open a demat account and start trading in no time.Financial markets thrive on the presence of participants. As long as there are buyers and sellers, the stock market increases in value based on volumes. Unfortunately, one of the primary factors that hold back potential traders and investors in India is the spread of misinformation about the world of online trading. Furthermore, many myths are surrounding a Demat account, and you must understand the difference between the myth and fact.To dispel such myths as well as to explore the question of exactly what is demat account let us take a closer look at the topic:

In India, trading used to take place by transferring securities in the form of physical certificates. However, in 1996, the Securities and Exchange Board of India (SEBI) introduced Demat accounts in the country, and it revolutionised investing by making it a digital process. One of the most important factors introduced by SEBI was a Demat account.

‘Demat’ refers to dematerialisation a process by which physical securities are converted into electronic format. Therefore, a trader can use a Demat account to hold, transfer, and transact securities without the hassles of dealing with physical securities. As a result, trading has become a safer, quicker and much more efficient method of storing securities and executing trades.

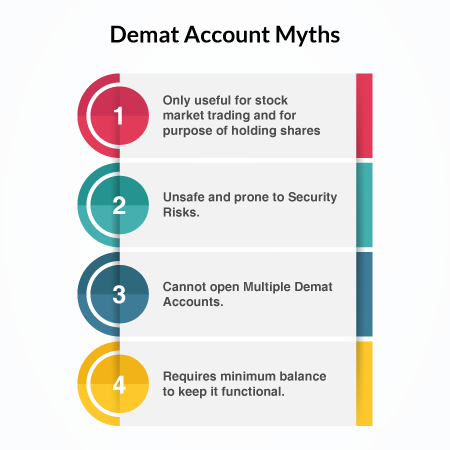

Here are some common myths regarding Demat accounts in India:

Demat accounts are only useful for stock market trading and only serve the purpose of holding shares.

Fact: Demat accounts serve a variety of trading purposes and can be used to store several types of securities. Demat accounts are beneficial if you are someone who likes to invest in equities as well as debt instruments. Demat accounts can be used to hold bonds, mutual funds, exchange-traded funds(ETFs), government securities, corporate FDs and insurance policies as well.

Demat accounts store securities in an electronic format, making them unsafe and prone to security risks.

Fact:This misconception is entirely based on the fears arising from the use of new technologies. However, Demat accounts are well protected from such breaches as per the strict guidelines laid out by the Securities and Exchange Board of India, or SEBI. DPs who open Demat accounts ensure that their trading platforms are safe and are equipped with appropriate firewalls to avoid financial fraud.

Moreover, your Demat account has a unique number, and you can only log in to your account through your unique, secure password. Furthermore, every transfer or transaction of securities that involve your Demat account requires its transaction password, making the access process safer.

Investors cannot open multiple Demat accounts and can only have one.

Fact:There are no limitations placed on a trader when it comes to opening multiple Demat accounts. Opening multiple Demat accounts is a common strategy used by traders to conduct different types of trading divided across various accounts. With a single PAN card, you can open multiple Demat accounts. In this case, If SEBI wants to review your trades, they can do so through your PAN card linked to all the opened Demat accounts.

A minimum amount balance is always required to keep a Demat account functional.

Fact:Even if your balance amount is zero, your Demat account will continue to be functional. There is no requirement of minimum value of holdings. You are not obligated to hold financial instruments in the Demat account at all times and are not bound by law to trade within a specific period.

Now that you know the answer to the question of what is a Demat account and have busted the myths that surround it, you can effectively start investing without falling for false information. The first step towards the process is to open a Demat account online with a reliable depository participant such as IIFL. With IIFL, you can avail of an all-in-one account through which you can trade in multiple securities online at your convenience.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.