Table of Content

What do we understand by squaring off a futures transaction? To understand how to square off futures position, remember that futures position can be either long or short. That means you could have either bought futures or sold futures. The square-off process is nothing but reversing your existing position in the futures market. That means if you have bought futures (long on futures) you can square off the position by selling equivalent quantity. On the other hand, if you sold futures (short on futures), the square-off process entails just buying back the futures position to make your net position nil.

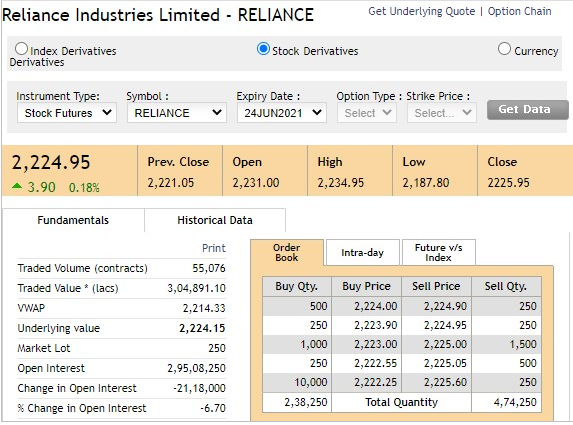

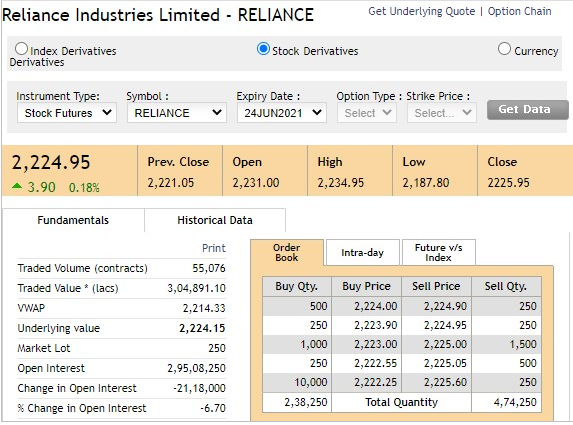

To understand the square-off process, let us look at two different scenarios on the same stock of Reliance Industries. Here is a live snapshot.

Scenario 1: Trader X had purchased 1 lot of RIL futures consisting of 250 shares at a price of Rs.2,195. Now X wants to understand how to square off his long position in Reliance futures in the market. To square off, X needs to sell 1 lot of RIL. At what price can we sell this one lot of RIL futures? He can sell at the Best Buy price of Rs.2,224. That is what the square-off process for a long position is all about. Let us look at the payoffs.

He bought the RIL 1 lot futures at Rs.2,195 and he can now square off the 1 lot RIL futures at the best buy price of Rs.2,224. That would entail a profit of Rs.29 per share of RIL (2,224 – 2,195). However, since the minimum lot size, in this case, is 250 shares, his profit in the deal would be Rs.7,250 (250 x 29). That will complete the square-off process. Now let us turn to scenario 2.

Scenario 2: Trader Y had sold 1 lot of RIL futures consisting of 250 shares at a price of Rs.2,270.90. Now Y wants to understand how to square off his short position in Reliance futures in the market. To square off the short position in RIL, Y needs to buy 1 lot of RIL. At what price can he buy this one lot of RIL futures? He can buy at the Best Sell price of Rs.2,224.90. That is what the square-off process for a short position is all about. You just reverse the short position by taking a corresponding long position in the same future for the same quantity. Let us look at the payoffs.

He sold the RIL 1 lot futures at Rs.2,270.90 and he can now square off the 1 lot RIL futures at the best sell price of Rs.2,224.90. That would entail a profit of Rs.46 per share of RIL (2,270.90 – 2,224.90). However, since the minimum lot size, in this case, is 250 shares, his profit in the deal for Mr. Y would be Rs.11,500 (250 x 46). That will complete the square-off process and that is how simple it is.

The above two scenarios were square off futures by the trader. Now, what about broker square off? This square-off process entails the broker closing your futures open position for several reasons. For example, the broker may forcibly square off the position if you have paid concessional margins for intraday closure. If you don’t close the position by 3.15 pm on the same trading, the broker will initiate the square-off process and close out the position. The other option is if the MTM losses are mounting and you are not able to bring in the necessary additional margins. In that case, the broker would again initiate a forced square-off process for the open positions as a risk management measure.

Contango is a situation where the futures price of a commodity is higher than the spot price. This is the normal situation because the futures price also includes the cost of carrying over the spot price. Normally, there is a contango that is equal to the cost of funds plus insurance and storage costs that is built-in for commodity futures. For equity and index futures, the contango normally only covers the cost of funds or the opportunity cost of holding the position. Contango usually occurs when an asset price is expected to rise over time. That results in an upward sloping forward curve.

When the contango premium becomes very high, it is called deep contango. That is normally an exceptional situation and does not last for too long. The reverse of contango is called backwardation wherein the futures are at a discount to the spot price.

Rollover may sound like a high-flying word but it is a simple term. You roll over to the next contract i.e., from near month to mid-month or from near month to far month or from mid-month to far month. These decisions are taken based on liquidity. Rollover is required when you are holding futures as a proxy for cash for the long term or when you are holding arbitrage positions.

So, in short, rollover is switching positions from the front-month contract that is close to expiration to another contract in a further-out month to carry forward of your future positions. Rollover becomes essential as futures contracts keep expiring on the last Thursday of each month. Here is how it works.

Yes you can avail auto square off as a risk management measure and you can also decide the triggers when the position will be square off the position.

Broker can square off the position under two conditions. Firstly, when the position is taken with lower margins for intraday then the position can be squared by the broker if the trader does not square off by 3.15 pm on the trading day. Alternatively, if the MTM margins are building up and the trader does not have the funds or is not able to bring in funds, the broker can forcibly square off the position in futures to protect risk.

Normally, the losses are your cost but some brokers also charge for forcible square off in the form of additional brokerage.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.