Table of Content

Currency options are a low upfront cost method of participating in the currency derivatives market. Like currency futures, currency options are also available on pairs like the USDINR, EURINR, GBPINR, etc. Like other options products, the currency options are also similar with the only difference being that the underlying is the currency pair with the INR being the second pair.

Let us understand what is options and currency options meaning in the context of the currency derivatives market in India. The currency options definition is exactly like any other option except that it is on a currency pair.

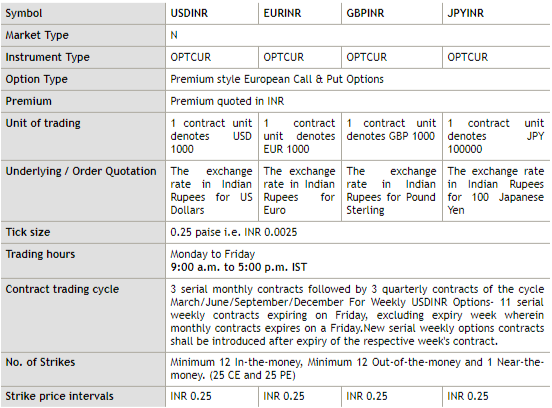

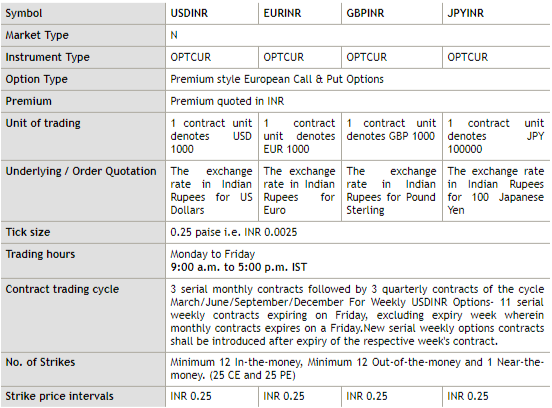

Before we understand what is currency options and the currency options definition, let us first understand the currency options meaning from the point of the spread of products available to trade. Like in the case of options on equities and indices, currency options are also a right (without an obligation) to buy or sell a currency pair. In terms of rupee currency pairs, there are options on USDINR, GBPINR, EURINR, and JPYINR. Here is what you need to know about currency options.

When it comes to currency options in India, there are rupee pairs and cross currency pairs in currency options too. Cross-currency pairs are non-rupee-based pairs. However, as of now, the cross-currency pairs are not too liquid and hence we focus more on the rupee-denominated pairs only.

Data Source: NSE

Data Source: NSE

Here are a few basic things to remember. All currency options are settled in cash only and there is no delivery at all. All these are European options which means they can only be exercised on the day of expiry and not before that. The notional lot value will be the same as in the case of currency futures which will be $1000 for USDINR, EUR1000 for EURINR, and GBP1000 for GBPINR contracts. Only the JPYINR contract has an equivalent notional lot value of Yen 10,000

Like in the case of currency futures, the currency options on rupee pairs are also available on the same four pairs. What is the logic of trading in currency options? If you expect the dollar to strengthen versus the rupee, you buy a call option on the USDINR. You can select the strike price based on your view. Similarly, if you are expecting the dollar to weaken versus the rupee, you can buy a put option on the USDINR. In the case of options, while the lot size is denominated in the international currency value, the premiums are denominated in Indian rupees. Currencies are less volatile so you have fewer chances of making profits on deep OTM options and they are best avoided.

Just like equities and indices, let us also understand the moneyness of currency options and how does it get interpreted. Moneyness indicates whether the contract would result in a positive cash flow (in-the-money), negative cash flow (out-of-the-money), or zero cash flow (at-the-money) for the option buyer. Here are the currency option categories.

For Call Option, it is ITM if the (Spot Price > Strike Price)

E.g., If the USDINR call option of Rs.73 strike is having spot price of Rs.73.50, it is ITM

For Put Option, it is ITM if the (Strike Price > Spot Price)

E.g., If USDINR put option of Rs.73 strike is having spot price of Rs.72.50, it is ITM

For Call Option, it is OTM if the (Strike Price > Spot Price)

E.g., If the USDINR call option of Rs.73 strike is having spot price of Rs.72.50, it is OTM

For Put Option, it is OTM if the (Spot Price > Strike Price)

E.g., If USDINR put option of Rs.72 strike is having spot price of Rs.72.50, it is OTM

The option price or option premium for currency options is the same as normal options and can be defined as (intrinsic value + time value)

Intrinsic value is fairly straightforward because it is measured by moneyness. The residual value in the option premium is the time value. The time value of the option is one of the most important concepts and helps in options trading.

For example, the USDINR July call option of 73.00 strike price is quoting at a premium of Rs.0.80 when the UDINR spot price is at Rs.73.60. What are the intrinsic value and time value of the option?

In the above case; intrinsic value of call = (Spot – Strike) = (73.60 – 73.00) = Rs.0.60 Time Value (residual value) = (Option premium – Intrinsic Value) = (0.80 – 0.60) = 0.20

The intrinsic value of the above option is based on moneyness but the time value of the currency option is based on time to expiry and the volatility of the stock price. From the above discussion, 3 things follow about the currency options.

The Black and Scholes model which we use for equity and index options can also be applied to currency options since the principle remains the same. Here is a quick look at the 5-factor model to value currency options.

| Black and Scholes Variable | When the variable moves up? | How does it impact the call option value? | How does it impact the put option value? |

|---|---|---|---|

| Spot Price of FX rate | Moves Up | Option value increases | Option value decreases |

| Strike Price of the option | Moves Up | Option value decreases | Option value increases |

| Interest rate diff | Moves Up | Option value increases | Option value decreases |

| Time to expiry | Moves Up | Option value increases | Option value increases |

| Volatility | Moves Up | Option value increases | Option value increases |

In case of volatility and time to expiry, the call and the put options on the currency pairs are impacted similarly. That is because volatility and time make the call and put valuable as they increase. Unlike the equity option where we used the risk-free rate, in the case of the currency option, we look at the movement of interest rate differential. In the case of USDINR, you track the difference between the US risk-free interest rate and the Indian risk-free rate. This will represent the interest rate differential depending on which currency pair you are buying the option on. Normally, it is the USDINR currency option that is the most liquid and the others are relatively less liquid.

Over-the-counter options or OTC options are privately traded options that are traded on a recognized stock exchange. OTC options are not standardized nor do they carry the counter-guarantee of the. clearing corporation. Hence they are riskier and more prone to liquidity risk. This is more popular among very large institutions where reputation holds the key.

In options, you trade strategies like the protective put, covered call, straddle, strangle, bull call spreads, bear put spreads, butterfly, etc.

You can buy and sell currency options through your regular trading account and you just need to activate trading once in these contracts. They can be traded in currency pairs just like your equity interface.

It is the USDINR, EURINR, GBPINR and the JPYINR pairs that are traded extensively. There are also cross currency pairs that are yet to pick up traction.

Valuation of currency options is also done using the Black and Scholes model which uses the volatility based pricing logic. There is also the binomial model where the answers are less authentic.

Foreign currency options are options on foreign currency pairs like the USDINR, GBPINR, EURINR etc.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.