Beta has become one of the most frequently used terms while talking about risk in financial markets. Beta (ꞵ) represents a stock or portfolio’s sensitivity to the market volatility. The beta coefficient is the exposure of an asset’s systematic risk and determines whether it is more or less volatile than the market as a whole.

Unlevered beta is the beta of a company or portfolio, without considering the impact of financial leverage, i.e., debt. It compares the risk of an unlevered company or portfolio to the risk of the overall market. It is also known as ‘asset beta’ because it describes the risk of a company only as a result of its assets, and not its debt. To put it in a nutshell, unlevered beta indicates the amount of risk a company’s equity contributes to its full risk profile.

‘Unlevering’ the beta of a company removes the impact of debt, whether favourable or detrimental, to the firm’s capital structure. Comparing the unlevered betas of different companies can help investors gain clarity about the composition of systematic risk while purchasing a stock.

Unlevered beta removes any impact of debt or financial leverage, only to isolate the risk contributed by a company’s assets. To calculate unlevered beta, you need to remove the effect of debt from levered beta.

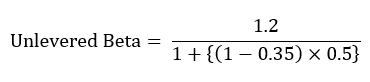

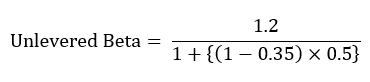

The effect of debt is calculated by multiplying the debt-equity ratio (DE ratio) with (1 – tax rate) and then adding 1 to this value. You can then calculate the unlevered beta by dividing the levered beta by the effect.

Unlevered beta is usually either equal to or less than the levered beta. This is because removing the effect of debt indicates seemingly less risk for a company. Debt and risk are positively related. When a company takes on more debt, it is translated into increased risk for the company.

In exceptional cases, a company’s debt effect can be negative, implying that the company is hoarding cash. In such a scenario, the unlevered beta of a company can be higher than its levered beta.

If the value of the unlevered beta is positive, it becomes favourable for investors to invest in a company’s stock when the market prices are expected to rise, i.e., during bull markets. If, on the other hand, the unlevered beta is negative, it is favourable for investors to invest in the stock when market prices are expected to decline, i.e., during bear markets.

Let us try to understand the calculation of unlevered beta with the help of a numerical example. Suppose this is the information given about Company X:

Calculated beta = 1.2

Debt Equity ratio = 0.5

Tax Rate = 35%

Thus, the unlevered beta of Company X is 0.91. This represents the systematic risk of the company without taking into account the effect of debt.

Therefore, unlevered beta is an important metric to measure a company’s risk if you do not want to account for its financial leverage. This metric also narrows down the systematic risk of a company to the risk only arising out of its assets or from its equity sources. This way, companies with varied capital and debt structures become comparable due to unlevered beta.

In the Capital Asset Pricing Model, the beta that is calculated accounts for the risk borne by taking more financial leverage. Hence, the CAPM beta is levered beta.

The beta calculated of an unlevered firm will be the volatility of the company, as compared with the volatility of the market as a whole, given that the impact of debt is not considered.

Since unlevered beta is the beta of a company without considering the impact of financial leverage, it describes the risk of the company only as a result of its assets, not its debt. Thus, it is also known as “asset beta”.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.