Table of Content

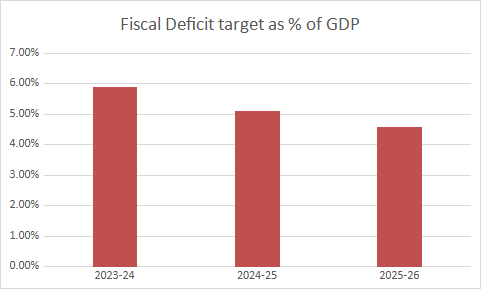

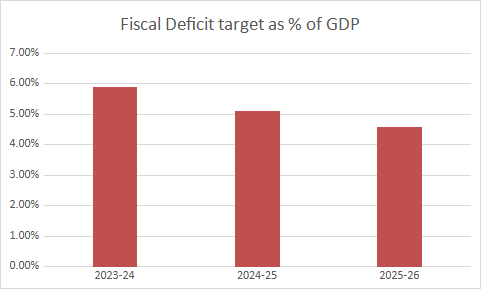

The key feature of Interim Budget 2024 is that it reiterated government’s commitment to fiscal consolidation and conservatism. It has set 5.1% fiscal deficit target for FY 25. For FY 26, the budget has projected fiscal deficit target of 4.6% of GDP. For FY 24, the revised estimate of fiscal deficit target has been kept at 5.8% of GDP.

Fiscal deficit target as a % of GDP between 2023-2026

The Financial Minister also said that the government will keep its borrowings in check so that interest rate costs do not go up on borrowings by the private sector. When government resorts to excessive borrowings, it raises the interest on borrowing by the private sector too. The happens because demand for borrowings go up. And lenders charge higher interest rates from private entities than what they charge from the government.

No changes were announced in direct or indirect taxes. Tax reliefs would have given a boost to consumption by increasing the disposable income of people. Consumption is an area in the economy that needs to be given a boost.

Much of the interim budget focused on highlighting the economic achievements of the current government in the past 10 years. The budget said that structural reforms have been done in the past 10 years by the government. These reforms have given a boost to the economy.

According to the interim budget, Rs 34 lakh crore worth of subsidies have been transferred through the Jan Dhan bank accounts in the past 10 years. This has resulted in savings of around Rs 7 lakhs crores for the government. These savings have taken place because of plugging of leakages in subsidies. These leakages or wastages take place when subsidies are given in non-cash form.

The Budget announced that average per capita income has increased by 50% in the past 10 years. Higher per capita income translates into higher standard of living for people. Some of the gains in per capita income in the past 10 years have been offset by the higher rate of inflation.

India-Middle East – Europe trade corridor has been identified as a kind of game changer in the interim budget. This corridor will improve trade connectivity between India, Middle East and Europe. This in turn will reduce transportation and trade time. Economic growth will be fostered because of this.

The Budget identifies Poor, Women, Youth and Farmers as priorities for the government. In order to give a boost to rural development, the budget announced construction of 2 crore houses in rural India in the next 5 years. Installation of solar panels on 1 crore rooftops will be done in the next 5 years.

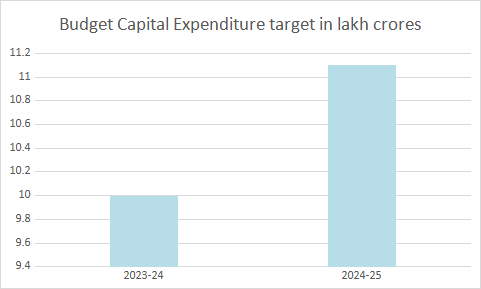

The Government continued with its strategy of giving a boost to GDP growth through increased government expenditure & investments. For FY 25, capital expenditure target has been set at 3.5% of GDP. This is an increase of Rs 11.11 crore or 11.1% over the previous year.

Budgeted capital expenditure in lakh crores

As part of increased government investment, three railway corridors will be constructed. These corridors will be dedicated to transport of energy, minerals and cement. 40,000 railway carriages will also be upgraded to Vande Bharat standards. To improve connectivity further, port development projects will be done in islands such as Lakshadweep.

Tax reliefs for investments by Sovereign Wealth Funds, startups and companies in IFSC – Gift city were extended by 1 year to 31st March, 2025. The budget announced setting up a Rs 1 lakh crore fund. This fund will give 50 year interest – free loans to companies in sunrise sectors.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.