Table of Content

Capital markets have consistently remained an attractive investment option for those looking for high returns. Financial awareness about the profit potential of capital markets coupled with lower yields from traditional investment options has led to a growing interest in capital market investment in the recent past.

The interest in the capital markets is evident with the highest number of Demat accounts opened in the year 2020-21 which broke all the records in the history of the capital markets. However, it is never too late to start investing in the capital market if you want to earn higher returns than other financial instruments.

Before you start investing, there are a few fundamental processes and terms you should know. It is important to understand how to transfer money from a Demat account to a bank account, transfer shares between two Demat accounts, and withdraw funds to be sent back to your bank account to ensure that your investment journey is hassle-free. But first, you need to open a Demat account. After opening an account, you must know how to transfer funds from a Demat account to the bank account and vice versa.

A Demat account is a digital account that holds the securities you buy virtually. Just as your bank account stores your money, your Demat account holds your shares, securities, bonds, mutual funds, and other assets. However, these are held digitally or as electronic copies in a dematerialised form. Dematerialization makes the process of virtually holding securities safe, easier, and convenient to transact once you start trading.

You can quickly invest in capital markets online as well as hold, monitor and trade seamlessly using a Demat account. One way to visualise this is to compare this to a godown where a businessman who sells detergent soaps stores the stock received from the manufacturer to sell it further to retail stores. Similarly, your Demat account holds your securities until you sell them to a buyer.

Along with a Demat account, you also need to open a trading account to buy and sell securities. A Trading Account acts as a bridge between the Demat and the bank account. A trading account reflects cash flow-debit or credit, unlike a Demat account which acts as a storage space for your securities.

Whenever you want to buy or sell a stock, a Depository participant places a request to the stock exchange for the same in your trading account.

If you have placed a request to buy, the stock exchange identifies a seller who has placed an order to sell a specific quantity of shares you are selling. Once a seller is identified, depositories issue orders to the clearance houses to debit shares from the Demat account of the seller and credit it to you, the buyer. However, the sale proceeds are credited to the trading account linked with your Demat account within T+2 days after you sell the securities. You can then transfer the money to your bank account once it is reflected in your trading account.

With a plethora of payment options available, you can easily transfer money from your Demat account to your bank account after selling some of your held securities. The entire process is online and hence paperless. You can do it conveniently on your mobile, tablet, or laptop.

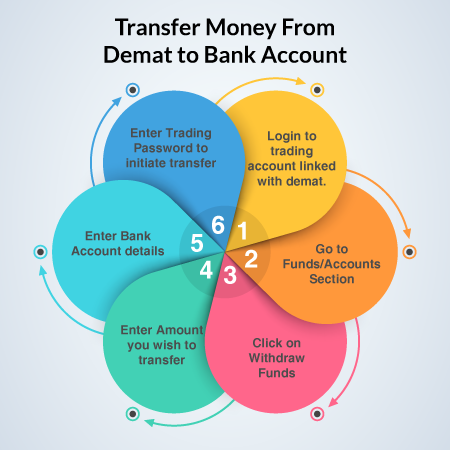

Here are a few easy to follow steps to transfer money from your Demat account to your bank account:

When you want to transfer money from a Demat account to a bank account or vice versa, you must keep the following information in mind:

Transferring funds from your Demat account to the bank account or vice versa is hassle-free, quick, and convenient. You just need to log in to your Demat account, select whether you want to add or withdraw money and enter the amount and trading password. The transfer is initiated and will be credited to or debited from your bank account.

You can opt for IIFL’s trading and Demat account, one of India’s best Demat accounts that allows safe and secure transactions in capital markets. Build a solid investment portfolio for your future and grow your earnings by opening a Demat account today.

If you are unable to transfer funds online, you can check with your brokerage service if they accept payments through Demand Draft or cheques.

If the funds have been transferred, but are not reflected in the Available Cash Balance then you need to check via net banking if the funds transferred have been debited from the bank account. If yes, then please get the Bank Reference number and provide the same to our Customer Care desk so that the funds can be updated in the Available Cash Balance.

Note: In case you still have doubts about Money transfer, please go through the HELP section on the Home page or Demos in the trading section in Money Transfer.

Invest wise with Expert advice

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Securities Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248

ARN NO : 47791 (AMFI Registered Mutual Fund Distributor)

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.