Table of Content

One of the most common terms you get to a year in the derivatives market is the term “Underlying Asset”. What is an underlying asset and how does it link to the F&O contract? To understand what is an underlying asset, we need to first know that futures and options are derivative products as their value is derived from another asset. If that asset value goes up, the value of this derivative also moves up or down, depending on what is this derivative we are talking about. That asset is called the underlying asset. So, the very Underlying Asset meaning is that it is the asset that defines the value of the derived contract.

If you have by now understood the Underlying Asset meaning, you would know that the contract and the underlying are the two sides of the same coin. For example, the underlying is the asset on which the derivative contract is built. The derivative contract derives its value from this underlying asset. Let us quickly sum it up.

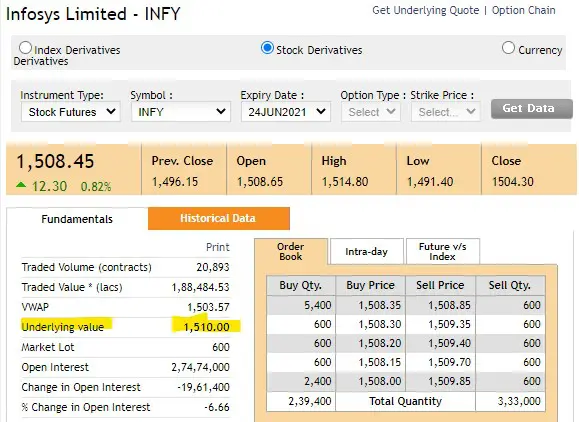

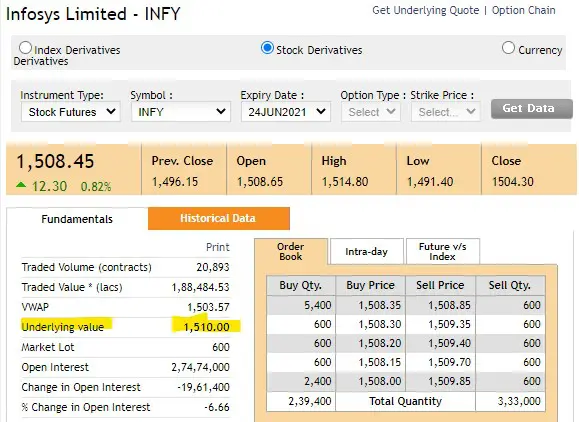

Let us take a live example of an Infosys contract to understand this distinction between underlying and contracts.

Data Source: NSE

If you look at the above snapshot of Infosys futures, here are some important inferences you can draw about underlying versus contracts.

That, surely, clarifies the essential difference between a derivatives contract and the underlying asset.

A calendar spread can be created using options or using futures, although futures are more common. This strategy is executed by simultaneously entering into a long position and an offsetting short position on the same underlying asset but with different maturity/expiry dates. For example, buying Nifty June and selling Nifty July futures or buying RIL June and selling RIL August. Both are instances of calendar spreads.

In a typical calendar spread, one would buy a longer-term contract and go short a nearer-term option with the same strike price, however, there is no such hard and fast rule. The normal rule is to buy the under-priced contract and sell the overpriced contract so that you gain from the spread narrowing. You are broadly indifferent to the price levels of the Nifty.

Calendar spreads are popularly referred to as horizontal spreads as they are across the same contract class across different maturities. This has to be understood distinctly from the popular F&O strategies like bull call spread and bear put spread which is two different strike prices for the same month and these are popularly referred to as diagonal spreads.

A future is a contract that will last till its expiry. On the day of expiry at the close of trade, the futures contract ceases to exist and is fully closed out and appropriate profits/losses are credited or debited to the respective holders of the contracts. For example, in stock futures in India, the contracts normally expire on the last Thursday of the month. That is the day the contract expires. On the day of expiry, the current monthly contract becomes worthless and a new far month contract is introduced by the stock exchange.

Of course, currencies are one of the most popular underlying asset classes in futures and options market. In the Indian market, the underlying in the currency contract future is the currency spread. For example, USDINR futures at Rs.73.50 is a contract where USDINR is the underlying. If you expect dollar to strengthen, you buy the contract and if you expect the dollar to weaken you sell this contract.

The underlying asset is valued on its intrinsic value. Equities are valued on cash flows and bonds are valued on interest rate yield movements.

The underlying asset serves as the benchmark for the pricing of the futures and options contract.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.