Table of Content

The exchange rate among two currencies that are not native to the nation where the quote is being given is known as a cross rate in the field of foreign exchange. A cross rate would be what you would obtain, for instance, if you were in the United States and wanted to know the exchange rate between the Euro (EUR) and Japanese yen (JPY). Knowing the idea of cross rates will help you make wise selections whether you’re an international student paying for your education abroad or a firm considering an overseas venture.

An exchange of foreign currencies between two currencies that are both valued against a third currency is known as a cross rate. In foreign exchange markets, the U.S. dollar (USD) is typically used as the unit of account to determine the value of the pair being exchanged.

The value of the U.S. dollar, as the base currency, is always one. Dollars are not the base currency in certain USD pairs, which are reciprocal.

Trading a cross-currency pair involves two transactions. First, the dealer exchanges one currency for its U.S. dollar equivalent. Next, another currency is exchanged for the U.S. dollar.

In the foreign exchange market, trading between two currencies takes place where a currency is valued by pairing it with another currency. Cross-currency pairs, or currency crosses, are some currency pairs that do not include the dollar. The currencies that are traded the most often include the U.S. dollar, Canadian dollar, New Zealand dollar, American dollar, Euro, and Japanese yen. Therefore, you would be trading cross-currency pairs when you traded any of these currencies with each other, eliminating the U.S. dollar from the list.

Cross rates are necessary in the following situations:

Let’s examine the conversion procedure even though there isn’t a set cross-rate formula.

Let X and Y be a currency pair, and let P be the base currency. The conversion process is as follows:

Step 1: Find X’s exchange rate in relation to P. It indicates how much of X is needed to make one unit of P.

Step 2: Determine the exchange rate between P and Y. This indicates the quantity of P needed to equal one unit of Y.

These constitute the concept’s fundamental logic, and it is divided into two main categories:

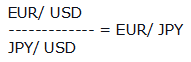

The amount of the quotation currency needed to buy one unit of the base currency is shown in a direct quote. Let’s use the EUR/JPY exchange rate as an example, where EUR is the base currency.

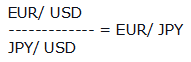

The amount of base currency required to purchase one unit of the quotation currency is stated in an indirect quote. Using the example of JPY/EUR, where JPY is the base currency.

The U.S. dollar (USD) is utilised as a benchmark currency in the foreign exchange market because it is the main reserve currency of the globe. Regular quotes against the USD are made for a number of currency pairs, including EUR/USD and GBP/USD.

Sometimes, though, there might be better strategies to value a currency in relation to the U.S. dollar. Deriving a cross rate exchange can enable businesses involved in international trade to conduct transactions more smoothly and provide more accurate insight into the exchange rate, both of which are useful for developing strategies for managing currency risk.

Comparably, international students would have to manage several currencies to pay for fees and other costs. Therefore, cross-rates play a crucial role in planning and budgeting.

Cross rates can be influenced by various things, such as:

Cross rates carry certain risks in addition to the potential for profit and portfolio diversification. Among these dangers are:

Trading professionals need to employ risk management techniques like limit and stop orders in addition to close observation of market circumstances in order to reduce these risks.

In the foreign exchange market, cross rate is a key idea that enables direct currency comparisons without the need for the U.S. dollar to act as a middleman. It presents chances for financial gain and portfolio diversity, but it also has hazards that need to be properly controlled. Traders can use this idea to make well-informed trading decisions if they have a basic understanding of cross rates and keep an eye on market conditions. Therefore, in order to successfully navigate the complicated world of foreign exchange trading, a solid understanding of cross rates is vital.

A cross rate is a quote from the foreign exchange market that compares two currencies, which do not include the U.S. dollar, to a third currency. The U.S. dollar is always perceived as having the value of one when utilised as the foundation currency.

The exchange rate between two currencies that are not both the base currency in the pair is called a cross rate. By analysing the exchange rates of the two currencies against a common third currency, the cross rate is found. The cross rate between EUR/GBP, for example, is calculated by dividing EUR/USD by GBP/USD.

Exchange rates from two distinct currency pairs are used to compute cross rates. For example, you should divide the EUR/USD exchange rate by the GBP/USD exchange rate to find the EUR/GBP cross rate. The figure that emerges will be the Euro-British Pound exchange rate, exclusive of the U.S. dollar.

News on currency cross rates can be found on a number of financial news websites, currency exchange platforms, and online trading platforms. Furthermore, a lot of financial institutions have real-time cross-exchange rate information available on their portals, including banks and forex brokers. However, in order to ensure accurate cross-rate statistics, it is imperative to confirm utilising trustworthy and current sources.

Fundamental ideas in the foreign currency market are cross and spot rates. The current currency rate quoted for immediate settlement or delivery on the spot date is referred to as the spot rate, sometimes known as the spot price. It shows the market worth at a certain moment in time, usually without reference to the U.S. dollar. A cross rate, on the other hand, is the value of two non-local currencies as an exchange rate measured against a major world currency, such as the U.S. dollar.

Yes, cross rates are regularly used by financial organisations and central banks in their different financial operations. These applications include foreign exchange interventions, risk management, and currency trading.

When a bank enters into a forward contract with an investor, it promises to exchange one currency for another at a later date. This exchange rate is known as the forward exchange rate, sometimes known as the forward rate or forward price.

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248, DP SEBI Reg. No. IN-DP-185-2016, BSE Enlistment Number (RA): 5016

ARN NO : 47791 (AMFI Registered Mutual Fund & Specialized Investment Fund Distributor), PFRDA Reg. No. PoP 20092018

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.