Table of Content

Before we get into the details of who is required and who is not required to file income tax return, let us understand what is filing an income tax return and why is it required.

Filing of the income tax returns (ITR) is a statement of your income across different sources, tax liabilities, the tax that has been paid and the refunds (in case any) that the government is supposed to give. Filing of the income tax provides proof for your income as legal and disclosed. It helps you in many ways such as getting refunds, applying for loans, applying for tenders, startup funding etc.

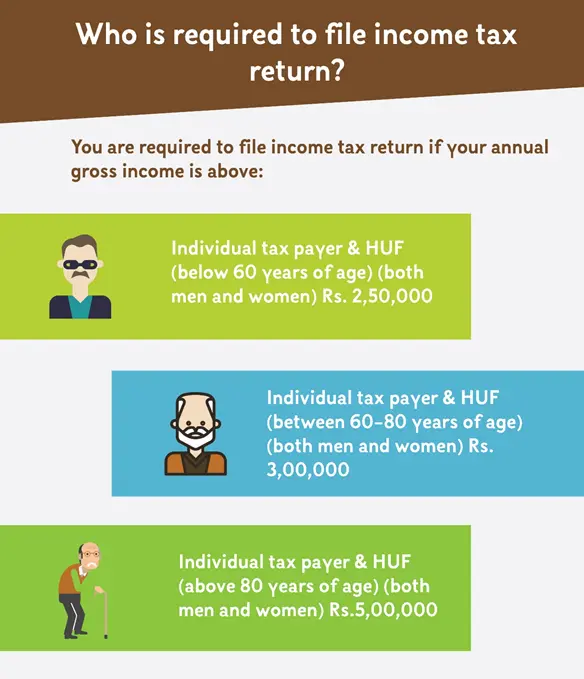

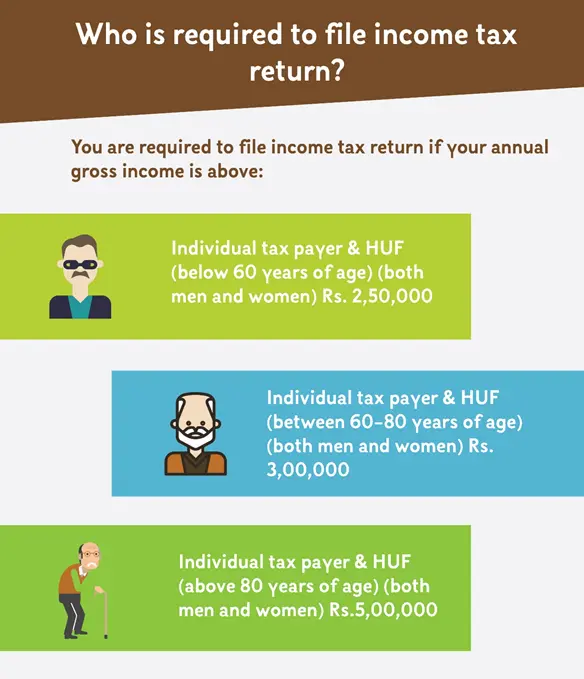

If you fall in any of the following criteria, then you are required to file income tax return:

If you are required to file income tax return (ITR) then you can file it by following the mentioned procedure.

You must have the following before filing ITR:

With the above-mentioned details, you can file your Income tax return by logging in on the portal and filling in the relevant details. This process is simple and can be done easily in no time.

Invest wise with Expert advice

![]() IIFL Customer Care Number

IIFL Customer Care Number

(Gold/NCD/NBFC/Insurance/NPS)

1860-267-3000 / 7039-050-000

![]() IIFL Capital Services Support WhatsApp Number

IIFL Capital Services Support WhatsApp Number

+91 9892691696

IIFL Capital Services Limited - Stock Broker SEBI Regn. No: INZ000164132, PMS SEBI Regn. No: INP000002213,IA SEBI Regn. No: INA000000623, SEBI RA Regn. No: INH000000248

ARN NO : 47791 (AMFI Registered Mutual Fund Distributor)

This Certificate Demonstrates That IIFL As An Organization Has Defined And Put In Place Best-Practice Information Security Processes.